Cannabis startup The Green Fund has launched a stock index for people who invest in Australian cannabis stocks.

A stock index is a detailed reference list that tracks the performance of publicly-traded companies on the stock market. Indexes typically compare the daily trading value, market capitalisation and the price-per-share of companies within a niche.

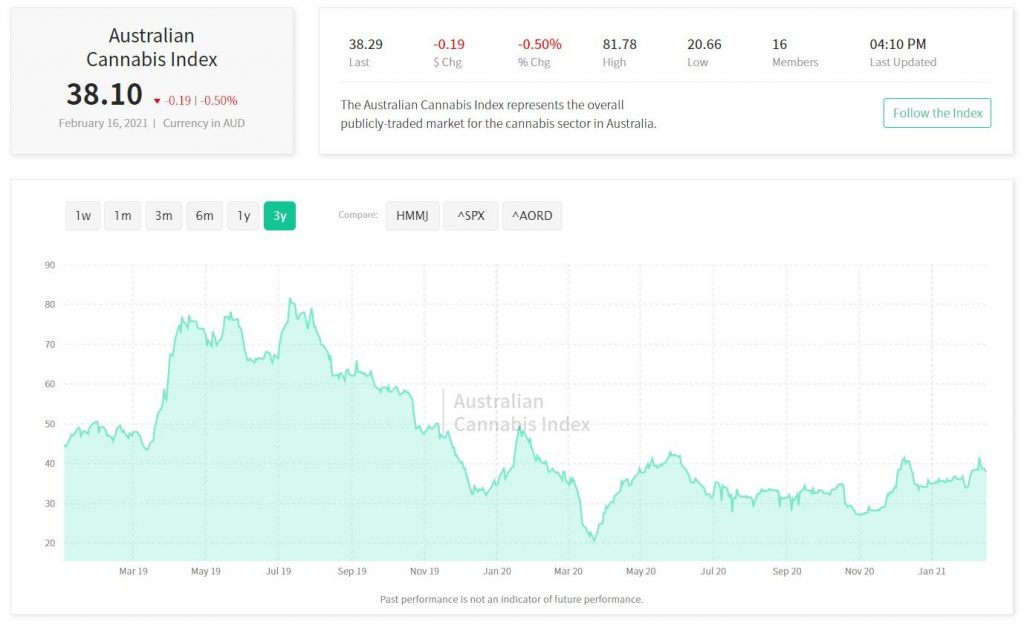

There are a handful of cannabis-related stock indexes globally, including the Canadian Cannabis LP Index, the North American Cannabis Index and the Global Cannabis Index. Now, a similar index has been launched for Australia’s cannabis industry – the Australian Cannabis Index (ACI).

To be included in the ACI, companies meet three requirements:

- Have a stock price above $0.01 over a 10-day average

- Hold an average market cap above $10 million

- Have a daily trading value above $50,000

According to Mark Bernberg, the founder of The Green Fund, the ACI will allow Australian investors to monitor the growth of the domestic cannabis industry and compare it to other, global indexes.

As the industry matures, the ACI can provide investors with a bird’s-eye view of the overall health of the Australian cannabis industry and the companies within it.

Although only industrial and medical cannabis have been legalised, Australia’s legal cannabis industry is expected to mature to a value of $1.5 billion by 2024, with current estimates of the legal and illegal market valued at $14.8 billion.

Bernberg’s stock index allows investors to compare Australia’s stock market against the All Ordinaries, the HMMJ (A Canadian ETF) and the S&P 500. The stock index is rebalanced quarterly.

So far, the ACI lists 16 publicly-traded cannabis companies – including Australia’s top cannabis stocks.